Once upon a time, valuing property was a secretive art. Only estate agents and mortgage companies could do it, as only they had the data.

Nowadays, anyone can do it. You can use Rightmove’s property valuation tool, or Zoopla’s. But this really is half the story. The key is understanding house price per square metre*.

Knowing price per square metre (or m2) lets you do the following:

- Value your home accurately when you’re selling

- Judge whether you’re over- or underpaying for a property

- Calculate if a home improvement (e.g. extension) is worth it

- Measure the affordability of an entire area, rather than just one property

*or price per square foot if you want to be imperial about it. A square metre is almost exactly 10x a square foot, if you want to do a mental conversion.

How to find house price per square metre

For an individual property, it’s easy. Take the sold price and divide it by the size of the house in square metres.

e.g. £298,000 divided by 112m2 = 2,660m2

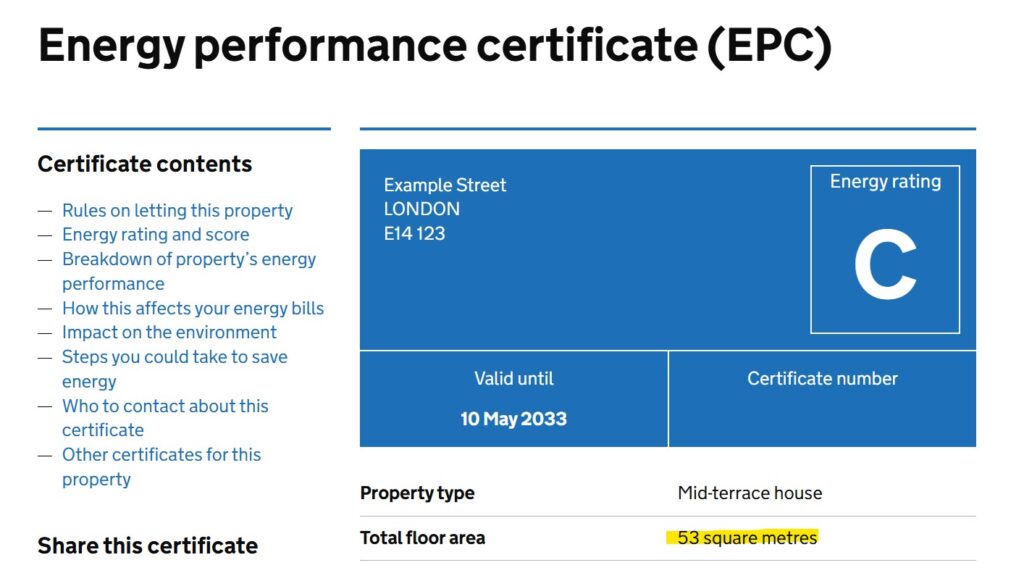

You can find the sold price of a UK property on the Land Registry (or Rightmove/Zoopla). You can find the size of a house on the EPC register (or, once again, Rightmove/Zoopla).

For larger areas (e.g. a postcode area), it’s more complicated. The best resource I’ve found is House Metric. It’s a real labour of love, but he’s essentially stitched together multiple datasets, to give aggregate results. You can look at whole counties, or individual postcodes. And there are maps, too.

Average price of of UK homes by area in square metres

The average price of a UK home is £3,105 per m2. This is based on an average UK house price of £291,828 and an average UK property size of 94m2 .

This varies significantly by location and type of property (e.g. flats, terraces, semi detached). And once you dig into the data, thanks to House Metric, it gets very interesting (and quite useful).

Here’s a summary of the average house prices per square metre in different UK regions:

- Under £1000m2: terraces in deprived areas (e.g. Hull, Sunderland)

- £1000m2 – £2000m2: terraces outside the Southeast

- £2000m2 – £3000m2: semi-detached houses in the North (e.g. Sheffield, Bolton)

- £3000m2 – £4000m2: semi-detached houses in the expensive North (e.g. Altrincham, York), the South West (e.g. Somerset), or South East (e.g. Hastings)

- £4000m2 – £6000m2: detached houses outside the South East, semis in the expensive South East (e.g. Brighton) and cheaper bits of London (e.g. Croydon)

- £6000m2 – £8000m2: detached houses in the expensive South East (e.g. Guildford), terraces in London (e.g. Richmond)

- £8000m2 – £20000m2: Other London houses and flats

The majority of homes in the UK are worth £2000-£4000 per square metre. This is primarily affected by area, but also by property type. And then of course you have outliers – some extremely nice streets, or properties with unique features or locations will be even more per square metre. And some will be cheaper if, say, there’s a recycling plant across the road.

I’ve taken a sample of a few locations to show this spread. It takes the lowest price of a terrace, the average house of a semi, and the highest price of a detached house.

| Area | Cheapest Terrace | Average Semi | Most Expensive Detached |

| Middlesbrough | £610 | £1,740 | £3,040 |

| Sunderland | £560 | £1,760 | £3,190 |

| Hull | £870 | £1,950 | £2,810 |

| Stoke | £820 | £2,030 | £3,610 |

| Boston | £940 | £2,100 | £2,940 |

| Bolton | £1,150 | £2,570 | £3,940 |

| Sheffield | £1,250 | £2,620 | £4,820 |

| Leeds | £1,270 | £3,020 | £4,830 |

| Norwich | £2,300 | £3,080 | £5,130 |

| Gloucester | £1,880 | £3,130 | £4,340 |

| Manchester | £1,470 | £3,140 | £5,020 |

| Somerset | £1,890 | £3,210 | £4,720 |

| Cornwall | £1,910 | £3,290 | £5,620 |

| Dover | £1,950 | £3,470 | £5,370 |

| Solihull | £1,720 | £3,750 | £5,990 |

| Hastings | £2,180 | £3,810 | £5,020 |

| York | £2,680 | £3,830 | £5,120 |

| Exeter | £2,730 | £3,870 | £5,220 |

| Cheltenham | £2,680 | £4,040 | £6,390 |

| Bristol | £2,930 | £4,040 | £6,770 |

| Trafford | £2,410 | £4,090 | £6,220 |

| Barking and Dagenham | £3,810 | £4,690 | £5,920 |

| Brighton | £4,080 | £5,000 | £7,550 |

| Croydon | £3,620 | £5,000 | £6,790 |

| Oxford | £4,080 | £5,290 | £9,450 |

| Guildford | £4,100 | £5,540 | £8,240 |

| Cambridge | £4,560 | £5,740 | £8,300 |

| Richmond | £6,250 | £8,250 | £13,740 |

| Camden | £7,930 | £12,500 | £22,580 |

How to use property price per square metre (practical examples)

Once you understand house price per square metre, you become less dependent on third parties such as estate agents. You can also make clearer decisions about moving and improving your home. Here are some examples:

- Valuing your property for sale: in many house sales, the list price is advised by your estate agent. This is fine, they are professionals after all. However, there are many, many instances where houses are priced wrong, especially too high, and sit on the market for ages. If you know what the average £/square metre is in your postcode, you can sense-check this list price, even if your house size is different to your neighbours. Let’s say you’ve done an extension and added 15m2 – well from the average in the UK you’d expect to be adding £46k onto the list price versus an equivalent property.

- Judging the value of a potential purchase: on the flip side, you always want to make sure you’re not overpaying when purchasing a property. Knowing average £-per-m2 is a crucial tool when house-searching, and when negotiating. Also bear in mind that not every m2 is the same – if people are including large conservatories, lofts, or outbuildings in their total, you can use your price-per-square-metre measure to judge the value without those metres.

- Calculating the ROI of extensions: if you’re extending your house in order to increase the sale value, you need to make sure it’s worth it. At its simplest level, you want to make sure that the cost of the work is outweighed by the increase in value. You can do this by knowing price-per-m2 of both the work and your local area. With the rise in building costs, extensions are now costing closer to £3,000 per square metre (and, in some cases, up to £,5000). If your property value is £3,000 per square metre (and it probably is) then you will not make money on the work. In fact it’s entirely possible that the boom time of extensions and loft conversions has passed. Then again, it depends on your circumstance. But it’s good to know in advance.

- Assessing the affordability of entire areas: let’s say you know you want to move from the city to a satellite town, or the countryside. But you’re not that bothered which satellite town, or bit of countryside. Understanding house price per square metre lets you assess an area at a glance, and compare with your current situation. For instance, if your Bristol semi is worth £4,040/m2 then you know you can get over 25% more space for the same money by moving to Somerset.

- Judging the cost of areas with good schools: it can also help you weigh up moving to a particular area for outstanding schools (which, unsurprisingly, carries a large premium). With VAT on private school fees (which were already rising sharply), more and more parents will be playing catchment area chess.